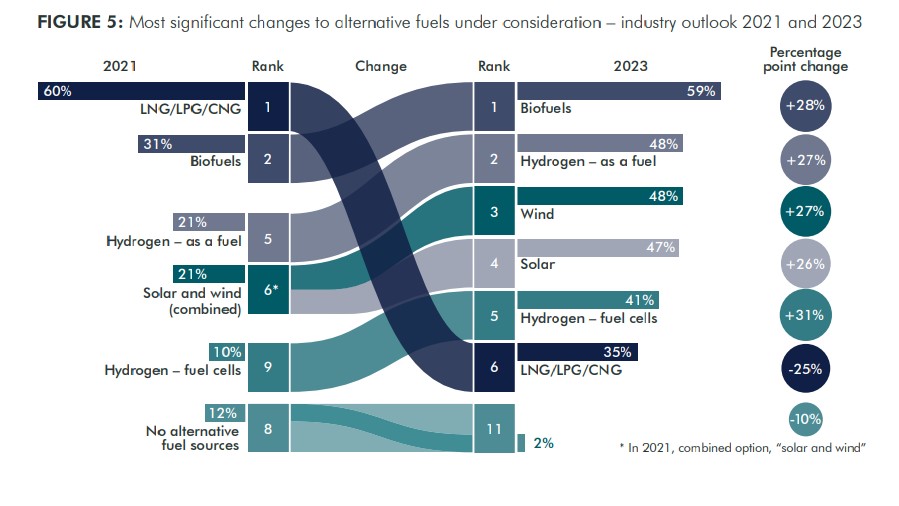

In 2021, LNG was the most popular alternative fuel considered by shipowners for use in the (then) next five years; twice as many as those who said they were considering biofuels.

That position has now virtually reversed, with biofuels at the same level of response as LNG in 2021 while LNG has fallen by nearly half.

These are the findings of a recent survey carried out by the London-based law firm Watson Farley & Williams (WFW) titled ‘The Sustainability Imperative – Part 2’.

The report is a continuation of s survey made two years ago and it explores how the attitudes of the stakeholders in the shipping industry have changed with regard to Environmental, Social, and Governance (ESG) goals.

When it comes to alternative fuels, the perception seems to have changed considerably over the past two years as the need for decarbonization of the sector became a widely acceptable factor in business operations and investment decisions.

WFW’s survey shows that in 2021, 12% of shipowners said they were not considering using alternatives to bunker oil within the next five years, a figure that has now dropped to under 2%.

The other big change is that LNG or LPG are being considered as alternative fuel sources by just 35% of shipowners, versus 60% in the previous survey. This may reflect rocketing gas prices, security of supply and growing awareness about ‘methane slip’ and the impact of methane emissions, or possibly a

recognition that gas is a transitional measure.

Replacing gas as the top choice among alternatives are biofuels, which almost 60% of shipowners are considering using by 2028. Almost half, meanwhile, are considering hydrogen (as a fuel), wind or solar power.

Biofuels are an easy fuel in the sense of handling and implementation as they can be used on the existing infrastructure. They provide an immediate solution to decarbonize shipping, as they can be blended or dropped into existing conventional fuels with little or no technological developments required on vessels.

While biofuels offer the potential to reduce greenhouse gas emissions and improve the sustainability of the shipping industry, their widespread adoption faces several challenges, including the availability of sufficient feedstocks, scalability, and cost-effectiveness.

Methanol and clean ammonia also are now considerably more popular than they were two years ago, although more shipowners are still leaning towards LNG/LPG, hydrogen, wind, solar and biofuels.

Batteries, in contrast, have slumped from the third to tenth most popular choice, possibly because storage technology is not advancing as quickly as expected. After all, more than 20% of shipowners say that tested technology and proven results are the most important factors in supporting one fuel source over another.

The survey data shows that there is still no perceived single solution and perceptions are continually evolving. And there are yet more options being contemplated – as evidenced by the debate around the potential of nuclear power and liquid salt reactors.

On average, each of the 182 shipowners and operators in the survey picked four fuel alternatives under consideration – a sign of the uncertainty about future fuel sources, most likely due to regulatory uncertainty.

“The biggest issue holding people back is the cost difference between low and zero-emission fuels versus fossil fuels,” Rasmus Bach Nielsen, head of fuel decarbonisation at Swiss commodities trading giant Trafigura, said commenting on the hurdles to accelerate decarbonization of the shipping industry.

“These fuels will not be produced for the shipping industry unless there’s more certainty of demand. And demand will only materialise if the cost gap is significantly minimised.”

A quarter of the survey responders believes this problem should be addressed by government subsidies and investment, though 30% think that shipowners will have to foot the bill. Surprisingly, this view is also shared by shipowners themselves.

Less than one-fifth of shipowners agree that the price difference should be tackled with a carbon tax or levy, but Nielsen says he believes “100%” that the solution is a global carbon pricing mechanism led by the IMO and operating on the ‘polluter pays’ principle.“

Action is needed as soon as possible if the industry is not to lose out to other sectors in the competition for renewable fuels. This means tougher emissions targets and urgent implementation of a viable shipping market for green fuels, Nielsen adds.

“There’s a risk that if demand for renewables from other hard to-abate industries matures faster, shipping will not be able to decarbonise at the pace it needs to because the hydrogen will not be produced as shipping fuel – it will be sold as pure hydrogen,” he warns.

The survey shows that voluntary initiatives have has a surprisingly effective impact on companies’ emission reduction goals, however, shipowners and other industry stakeholders are clear that further ESG progress – particularly on the environment and governance – must be driven by global regulation.

Therefore, all eyes are set on the IMO’s MEPC meeting in July this year when the sector’s governing body is expected to revise its GHG strategy aligning with the Paris emission reduction goals, setting a clear signal to the sector.

The WFW survey covered 500 senior-level responses including shipowners and operators (40 pct), charterers (14 pct), and financiers (46 pct). Respondents from Europe, the Middle East,

and Africa and those from Asia-Pacific comprise 44% and 37% of the survey respectively, while the rest are from the Americas.

Por offshore energy